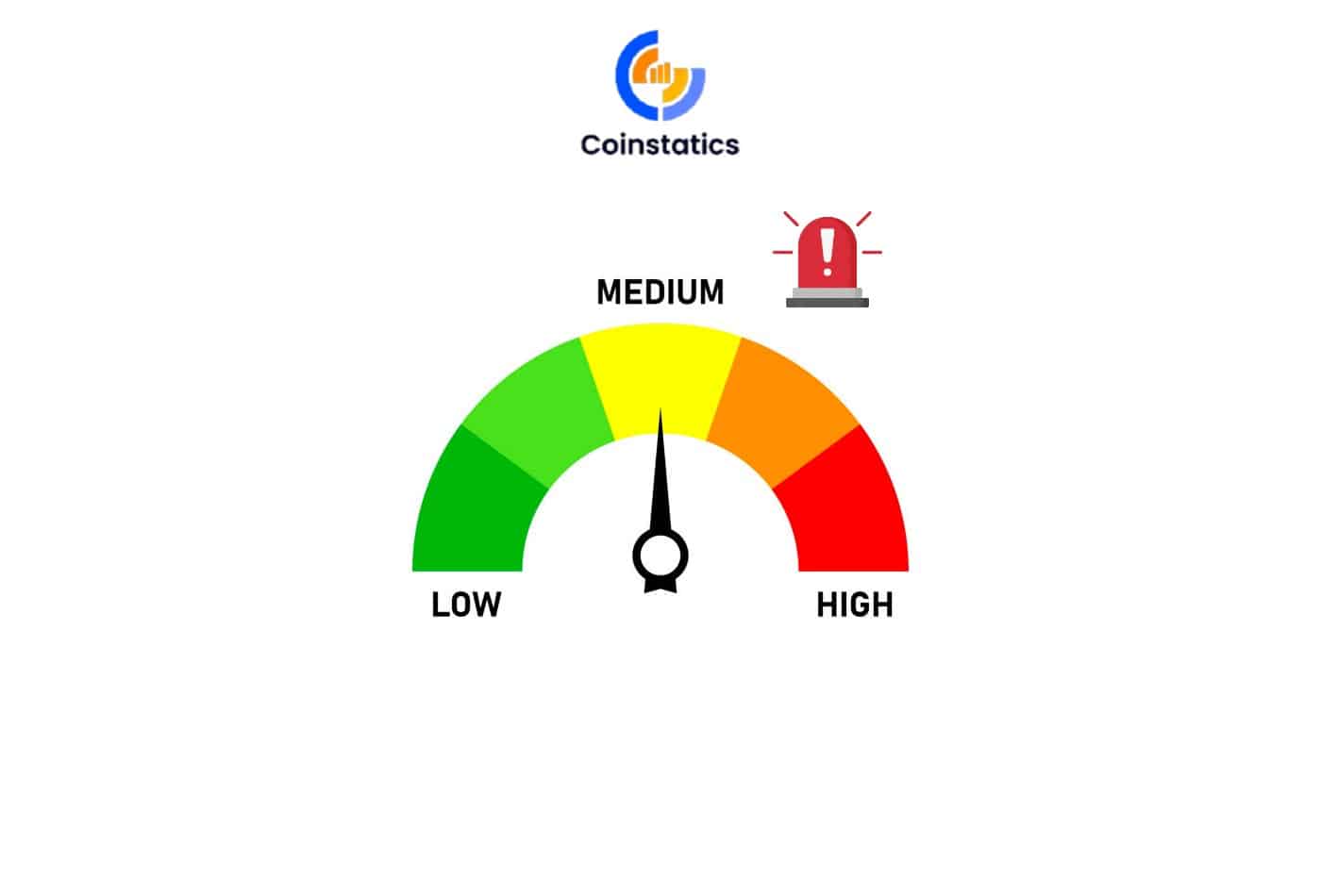

Unlock the Secret Strategy That Could Transform Your Forex Trading Risk Overnight

It’s crucial to keep in mind that both a high risk-to-reward ratio and a low risk-to-reward ratio don’t always indicate that a transaction is good. Along with risk-reward ratio, several other elements should be taken into account, including market conditions, technical and fundamental research, trading techniques, and risk management measures.

INTERESTING ARTICLE: Forex Scalping Strategies For Beginners

Traders should take into account the risk-to-reward ratio at several levels, such as the stop-loss level and the take-profit level, in addition to calculating the ratio for the entire trade. In addition to making sure that the stop-loss level is acceptable in light of the market conditions, a trader should attempt to set stop-loss orders at a level where the risk-to-reward ratio is advantageous. The risk-to-reward ratio should be favorable for setting take-profit levels as well.