Unlock the Surprising Daily Rituals of Lower-Middle-Class Achievers That Financial Experts Swear By

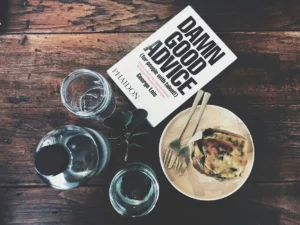

Every day, I dedicate at least 15 to 30 minutes to learning something new—whether it’s brushing up on marketing techniques, exploring a fresh personal branding strategy, or reading about emerging tech trends.

What’s fascinating is that daily learning isn’t just about picking up hard skills.

It also cultivates a growth mindset. If I’m consistently learning, my brain stays open to new possibilities, better job prospects, or side hustle ideas.

That’s a crucial part of moving up the financial ladder. It’s like investing in personal “intellectual equity.”

Try scheduling a fixed time—maybe early morning or during lunch—for learning. Even a few pages of a book or one insightful podcast can plant a seed that later blossoms into a career opportunity.

3. They cultivate strong relationships

I’m convinced that relationships are at the heart of success.

Early on, I underestimated the power of professional and personal networks.

But building authentic connections can do wonders for your confidence, your career, and even your wallet.

There was a time I enrolled in a local workshop on branding.

It wasn’t overly expensive, yet it opened doors to collaborations and led to a consulting gig that boosted my income.

Often, people assume that networking is about swapping business cards, but I’ve found it’s more about genuinely connecting on shared values or interests.

Financial experts will tell you that success often depends on who you know as much as what you know.

When you invest daily effort into nurturing relationships—sending a supportive message, checking in on a contact, or brainstorming mutual projects—you’re essentially adding to your “social capital.” Down the line, this social capital can translate to job referrals, partnerships, and other opportunities that accelerate financial growth.

4. They invest in self-care

We talk a lot about financial investment, but how often do we discuss mental and physical well-being?

My wife always tells me that if I’m not taking care of my mind and body, no amount of money or connections will matter in the long run.

Lower stress levels and good health pave the way for clearer thinking, fewer sick days, and more resilience in the face of challenges.

Brené Brown, a research professor often cited in discussions about vulnerability and personal growth, has emphasized the importance of self-compassion.

While she’s not a financial expert per se, her insights on well-being align with what money gurus say: you need consistent emotional and physical balance to sustain the energy required for success.

For me, self-care means a short morning meditation, a quick workout, and taking breaks during intense work sessions.

These small habits keep me focused, energized, and ready to tackle whatever the day throws my way.

5. They save and invest consistently

I once believed that only people with hefty salaries could really invest.

Then I read an insightful piece on Forbes that clarified how even modest, steady contributions can compound over time.

The key is consistency. Lower-middle-income earners who make it big often set up automatic transfers to a savings account or an investment platform, ensuring they pay themselves first.

When I started doing this, I noticed how quickly my account balances grew.

It wasn’t dramatic at first, but the routine of moving even $50 a week into an investment fund made me feel a sense of progress.

It’s a habit that leverages what financial experts call “the magic of compounding.” Essentially, those small amounts earn returns over time, and those returns earn returns of their own.

If you’re new to investing, consider user-friendly apps that let you begin with minimal contributions. It’s less about being perfect and more about simply getting started and committing to the process.

6. They embrace a problem-solving mindset

People who succeed in boosting their financial situations often have an interesting daily habit: they treat problems like puzzles to be solved, not roadblocks.

I’ve found this mindset transforms how you approach everything from job challenges to personal finance hiccups.

For example, when I wanted to increase my monthly income, I could’ve just complained about stagnant wages in my field.

Instead, I brainstormed ways to offer more specialized services in my branding workshops.

This problem-solving approach led to new packages that appealed to niche audiences, thus increasing my revenue.

According to Adam Grant, an organizational psychologist, the habit of rethinking challenges and seeking innovative solutions is a hallmark of successful people.

Every day, I try to identify a pain point—maybe it’s a scheduling conflict or a budgeting dilemma—and ask, “What’s one small action I can take today to move forward?”

This habit builds resilience and keeps you actively engaged in improving your situation.

7. They set clear boundaries around leisure time

I’m a big believer in fun and relaxation.

After all, we work hard for a reason—we want to enjoy our lives.

But there’s a fine line between healthy downtime and habits that drain our resources.

Some people spend hours scrolling social media or splurging on unnecessary treats just to feel momentarily better.

What I’ve noticed is that financially successful individuals in challenging income brackets are deliberate about how they spend their free time.

They schedule breaks, hobbies, or family outings with a purpose, rather than letting them turn into expensive or unproductive habits.

This doesn’t mean life should be all work and no play.

It simply means they’re mindful of budgeting both their money and their leisure hours.

When I plan a day at the beach with my kids or an afternoon at the dog park with our golden retriever, I ensure it’s something that genuinely recharges me without breaking the bank.

It’s a balancing act that keeps me both rested and financially on track.

8. They review their progress every night

I used to end my day just by switching off the lights and hoping for the best tomorrow.

But there’s a technique many financial coaches advocate: daily reflection.

It’s a simple routine of checking how your day went—where you spent money, how you managed stress, and what lessons you can take into tomorrow.

This habit of reviewing progress doesn’t have to be lengthy.

Sometimes I scribble down a quick note about a productive conversation or a missed opportunity.

Over time, these small reflections help me spot patterns.

Am I repeatedly overspending on the weekend? Did I miss a chance to pitch a new idea at work? By identifying these patterns, I can course-correct and keep growing.

Financial experts say that consistent self-awareness is the key to sustained improvement.

When you know what’s working and what’s not, you’re more likely to make informed, positive changes.

So, if you’re looking to elevate your life and your finances, start by picking just one of these habits to adopt this week. Over time, you can add more.

After all, success isn’t an overnight event—it’s a steady climb that begins with the simple, consistent steps you choose to take every day.